Record Integrated Payment Processing Transaction Fees with Quickbooks

Note: These instructions are for the desktop version of QuickBooks. The process is similar in QuickBooks Online. When saving a deposit the credit card fees will need to be added as a negative line.

Export with QuickBooks Desktop

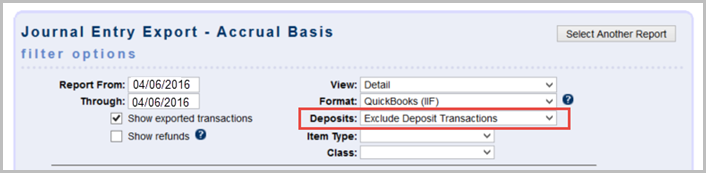

1. When creating the Journal Entry Export file, select Exclude Deposit Transactions for the Deposit choice.

2. Export and import your detailed IIF file as normal.

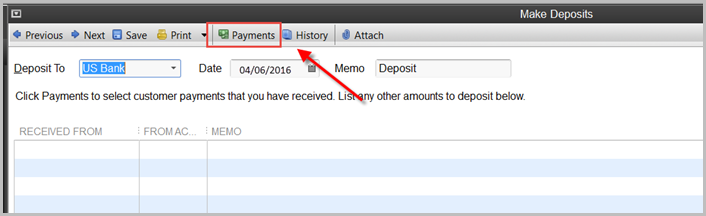

3. To record your deposit in QuickBooks, go to Banking, Make Deposits (or click Record Deposits on the Home screen).

4. Click the Payments button to view all payments which will include those brought over through your journal entries.

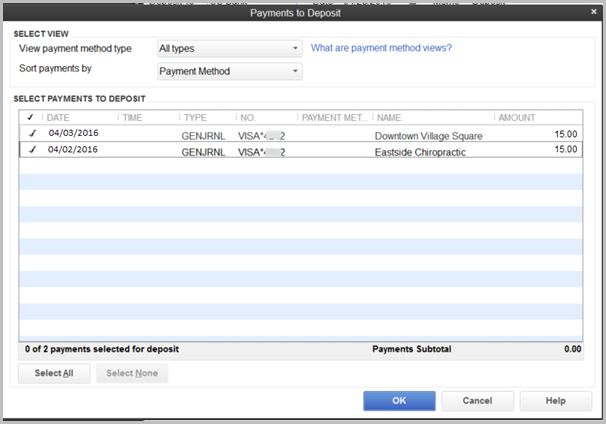

5. Select the payments that are included in the deposit and click OK.

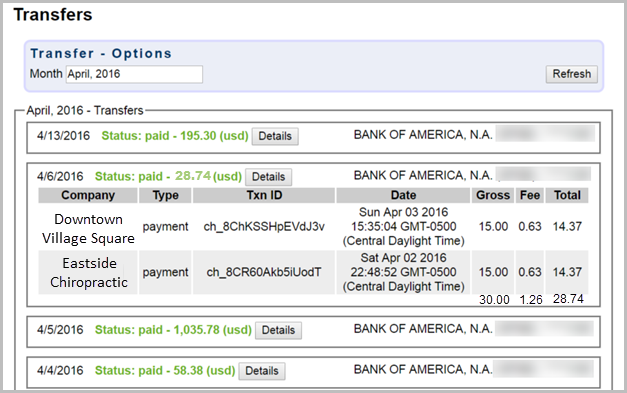

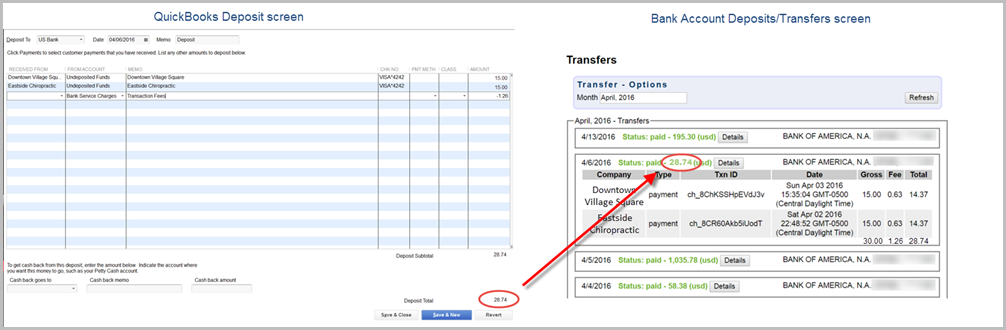

Note: Find the list of payments to include in your deposit by viewing the Bank Account Deposits/Transfers report under Billing ➝ Reports ➝ Payment Processing Reports / Management Tools in your ChamberMaster or MemberZone database.

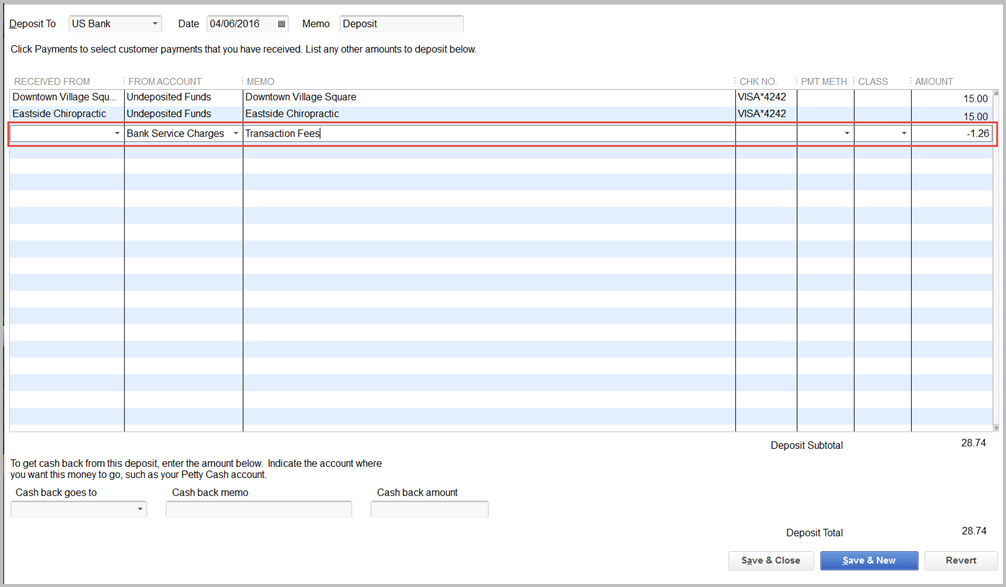

6. On the QuickBooks Deposit screen add a new line item to record the transactions fee.

Note: A typical account to select is a Bank Service Charge expense account. Enter the total transaction fee amount for that deposit with a negative value.

7. Verify that the bank deposit total matches the deposit total on the Bank Account Deposits/Transfers report.

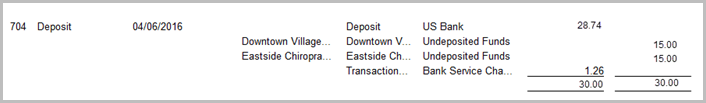

Note: In this example, the Journal entry for the deposit appears like this in QuickBooks.