Recognizing Deferred Income

Deferred income recognition is a bookeeping process used to recognize the income that was received all at once over a period of time instead.

Typically the way it works would be the billing is done against the deferred liability account(s). Then when it comes time to recognize that income the Recognized Income Report is run to determine what revenue needs to be moved from the deferred liability account(s) to the actual income account(s).

Contents

Recognized Income Report

The recognized income report allows you to easily get the totals of the revenue that needs to be recognized each month.

Setup

Before you can use the recognized income reports you need to have your account codes assigned within your chart of accounts. Each deferred liability account should have it's own account code so that revenue can be recognized and moved to it's appropriate income account each month.

Setting up the required account codes is done through the Chart of Accounts See Chart of Accounts for more details.

Using the recognized income report

To run this report you will need to

- Go to the Billing module and select the Reports tab.

- In the Executive section select the appropriate version of the report by payment date or invoice date.

- Specify the report date and select the account code you wish to report on and adjust any other options as desired.

- Click Refresh Report to generate your report which you can then review on screen, download or print.

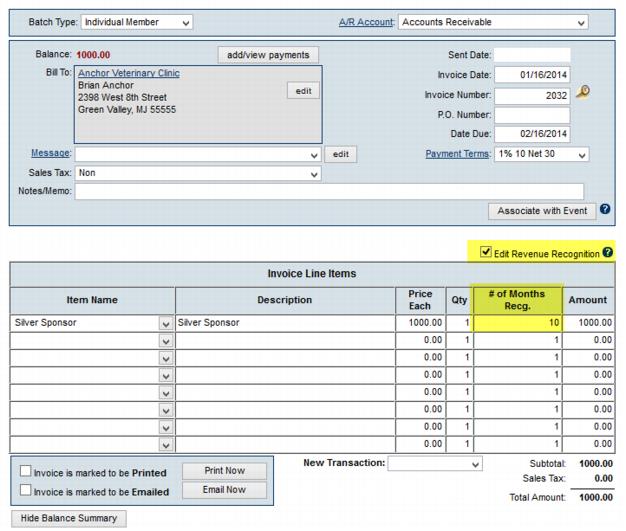

What is the Recognized Income checkbox that appears when I create invoices?

Those that recognize income on a deferred basis have an option to defer income on any invoice line item. A checkbox appears on invoices that allows you to specify the number of months that the income should be recognized over.

Recognition of this income would begin on the Invoice date and be displayed on recognition reports such as Recognized Income Detail and Recognized Income Summary in the Billing, Reports tab. This report also could report the deferred income based on Due Date as well. Previously, recognized income was only possible with membership fees and due items. This selection makes it possible to recognize deferred income for any invoiced item.